For those of you who are familiar with digital monetary transactions Cash App is a method of payment you might have come across frequently. Cash App is a mobile Payment service in the US and UK. It lets people send money to each other using an app on their phone. Similarly, as a Cash App user, there may be some options and buttons whose purposes aren’t instantly clear. The Cash Out option is one of the first things you’ll notice when you visit the Money page.

For consumers who would rather move their money from the app to a bank account, this function is essential. If you don’t regularly use the app for spending, knowing how to use Cash Out can help you manage your money more skillfully. We’ll explain what the Cash Out option does and show you how to use it in detail in this help. We’ll talk about everything, from how to connect your debit card or bank account to how to pick between standard and instant payments.

Simple Answer

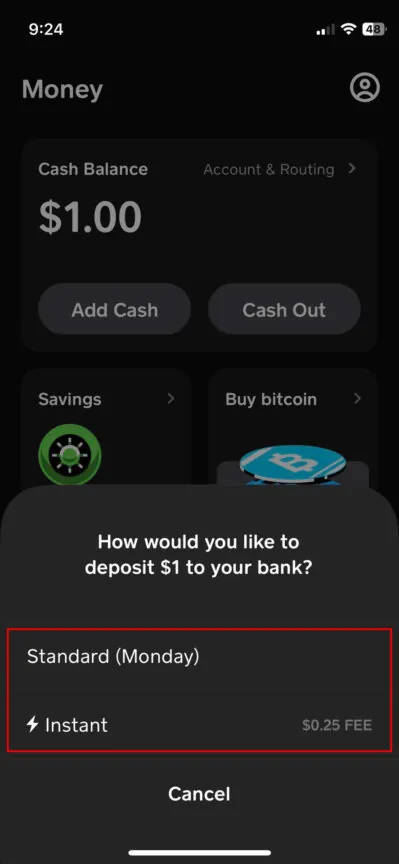

You can move money straight from your Cash App balance to your associated bank account by using the Cash Out feature. But first, you must link your debit card or bank account to the App to utilize this feature. You can choose the standard transfer, which is free but takes a few days, or the instant transfer, which is fast but costs a small fee.

These steps were made with Cash App version 4.23.0 on a Google Pixel 7 running Android 14. We also checked the steps on an Apple iPhone 12 Mini running iOS 17.2 to make sure they work the same way on all devices. Keep in mind that the steps you need to take may look different on your gadget, software, or app.

What Does Cash Out Mean on Cash App?

The “Cash Out” feature on Cash App allows you to transfer your balance directly from the app to your linked bank account. If you need to transfer money to your primary account or don’t often use the app for spending, this is quite helpful. You have the option of a quick transfer or a normal transfer when you choose the Cash Out option.

This type of deposit is free, but it can take up to three days to process and get to your bank account. Instant payments, on the other hand, have a fee of at least $0.25 and range from 0.5% to 1.75 %. This guide will help you understand how to use the Cash Out tool to keep track of your money better.

Other Relevant Articles to Explore: What Does GMFU mean on Instagram

How to Cash Out on Cash App

You must first link your bank account or debit card in order to take money out of your Cash App balance and deposit it into your bank account. Here’s a detailed how-to:

Link a Debit Card to Cash App

- Launch Cash App

Launch the App on your device.

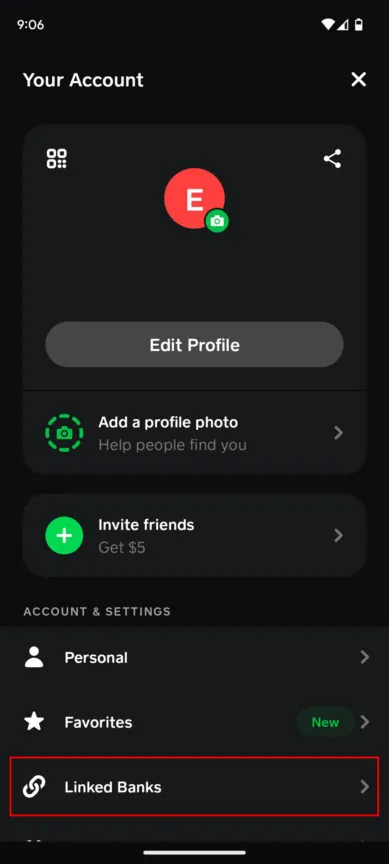

- Tap on profile

Touch the icon for your profile that is in the upper left corner.

- Tap Linked Banks

Select “Linked Banks” from the menu.

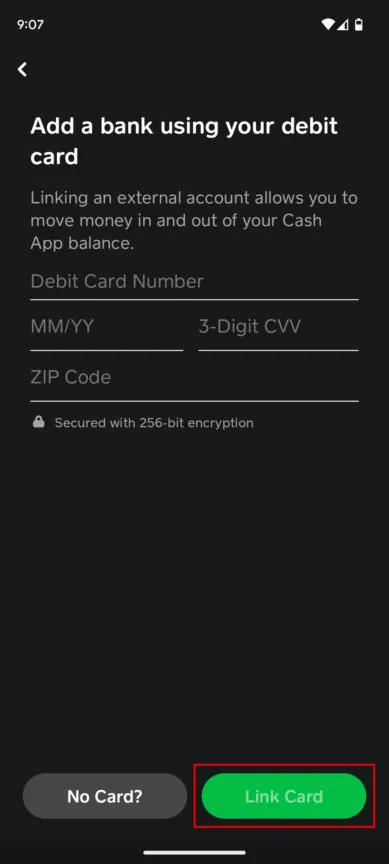

- Link your Debit Card

Choose “Link Debit Card.”

- Enter your card details

Enter the card number, expiration date, and CVV of your debit card.

- Finalize the linking process

Tap “Link Card” to complete the process.

Other Related Articles to Explore: If You Unfollow Someone On Instagram Do They Get a Notification

Link a Bank Account

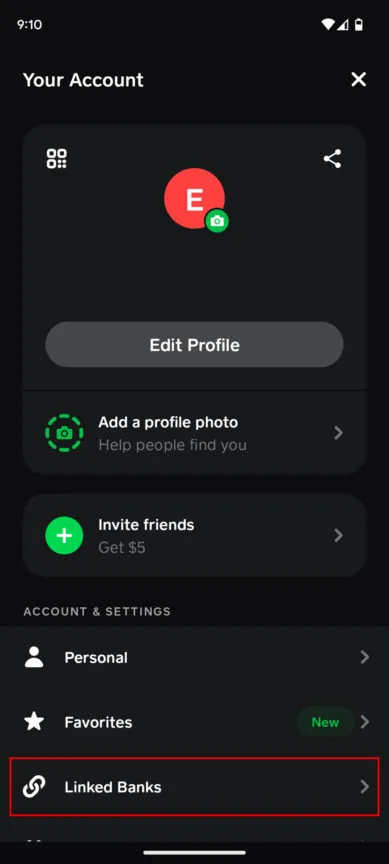

- Open the App and navigate to your profile by tapping your profile icon.

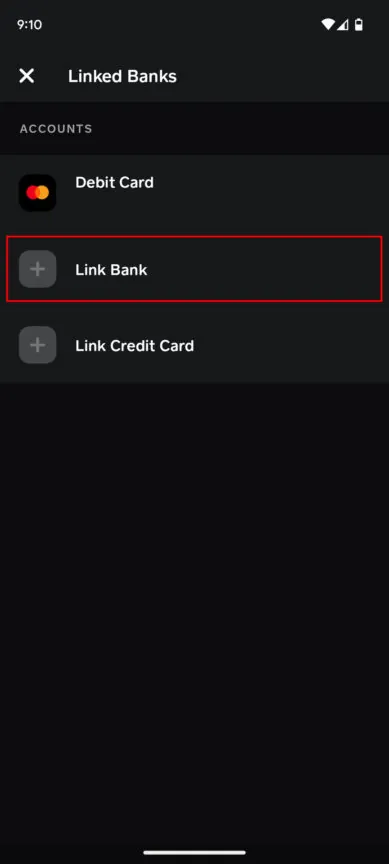

- Select “Linked Banks” from the menu options.

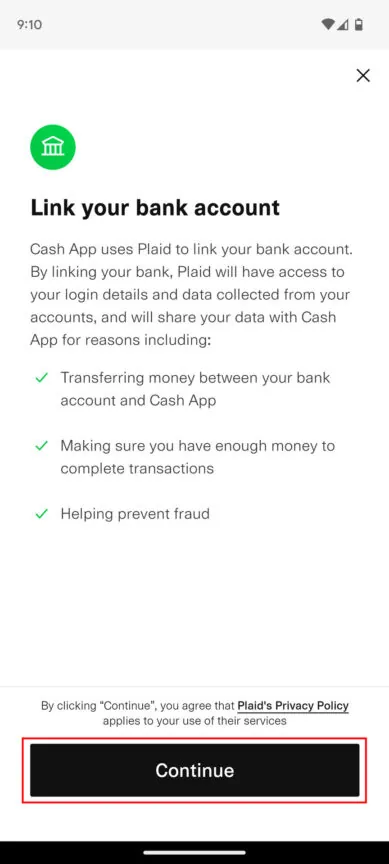

- Selecting “Link Bank” will cause the app to launch Plaid, a third-party bank linking service.

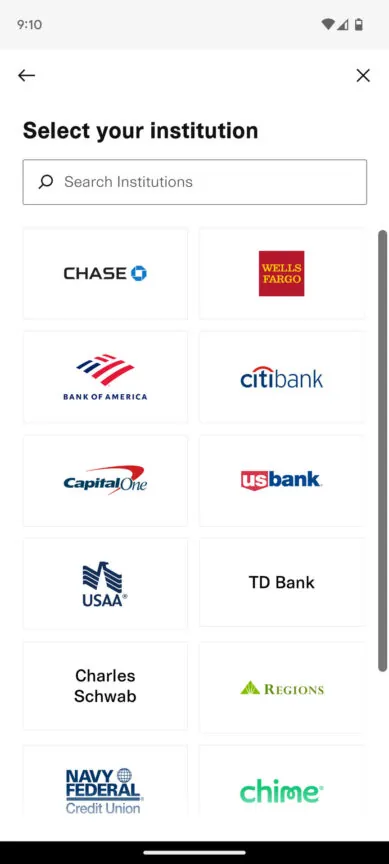

- Tap “Continue” and search for your bank by name.

- To link your bank account, go to Plaid’s instructions.

- Once linked successfully, tap “Done” to finish.

Cashing Out

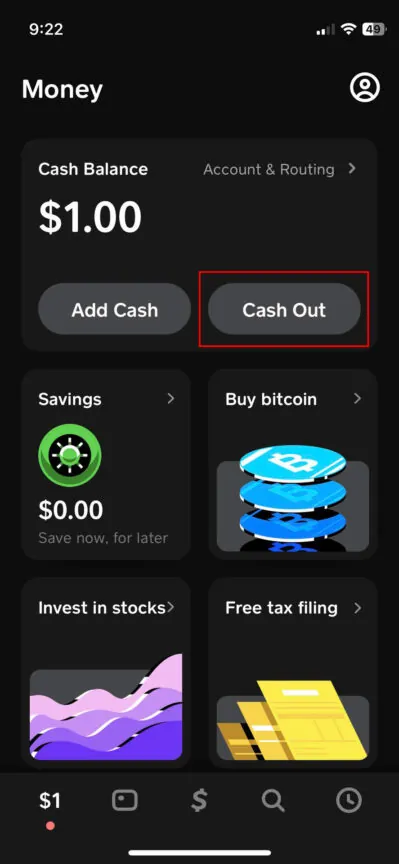

- Launch the App and navigate to the Money page, represented by an icon resembling a bank building.

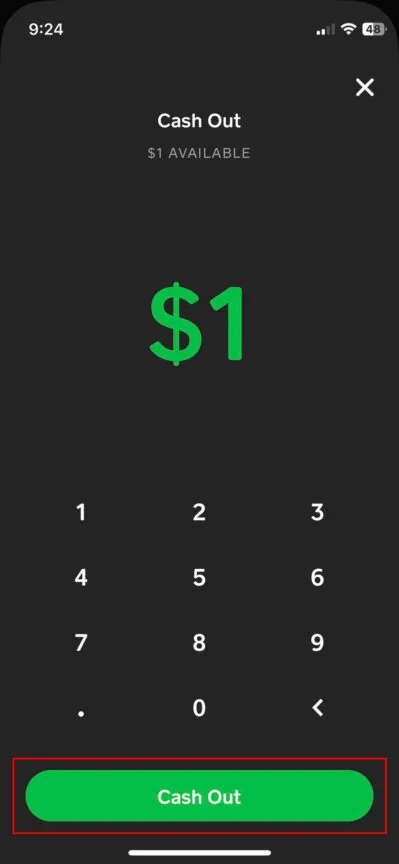

- Tap “Cash Out” and select the amount you want to transfer to your bank account.

- After choosing the amount, iOS users might need to confirm the Cash Out option once again.

- Select between “Instant” transfers (which carry a price of 0.5% to 1.75%, with a minimum fee of $0.25) and “Standard” transfers (which are free but take 1-3 days).

- After you confirm, the app will start the transfer as soon as you tap the choice you want.

You can also explore: What does YHU mean in Texting?

Conclusion

If you want to use the Cash App to manage your money well, you need to know how to use the Cash Out tool in particular. For your ease, you can link your bank account or debit card to the Cash App so that money can be sent easily from your Cash App balance to your main bank accounts. Customers can choose the choice that best meets their needs for speed and ease of use, whether it’s a regular transfer, which is free but takes a few days, or an instant transfer, which costs a little more.

Additionally, to ensure a smooth user experience, it is important to learn the steps needed to connect accounts and make trades. Even though technology is changing quickly, the app still has a lot of useful features for handling money transfers. These features let users handle their money safely and without any problems. If you follow these tips, you’ll be able to use the feature with confidence to keep track of your assets and send money safely whenever you need to.

FAQs

No, before you can use the Cash Out option, you need to link your Cash App account to a bank account or debit card. To safely move money from the app balance to your bank account, this connectivity is required.

Yes, there are fees depending on the transfer type:

1. Standard Transfer: Free of charge, but takes 1-3 business days to reach your bank account.

2. Instant Transfer: Incurs a fee ranging from 0.5% to 1.75% of the total amount transferred, with a minimum fee of $0.25. Instant transfers are processed immediately.